Local independent financial adviser, Becky Hammonds of Willow Financial Solutions, looks at the reality behind low rates on Cash ISAs and why it is worthwhile seeking better paying long term investments.

Britain’s biggest names will pay savers as little as 1 per cent interest per annum on each £1,000 in their cash ISAs. Some of the highest rates on offer are only 2 per cent – netting the princely sum of £20 per annum on £1000 investment tied up for three years.

The appeal of cash ISAs is that your interest is automatically tax-free. But low rates have meant that most for savers, the prospect of paying tax is almost non-existent and so they are now ditching the once-popular accounts in their droves.

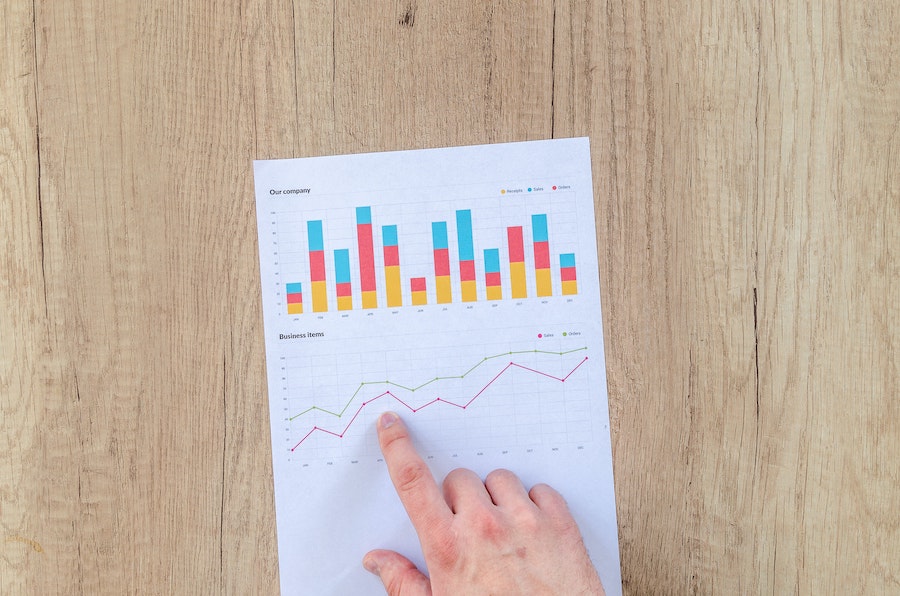

There are stocks and shares ISAs available that offer a better return and even for cautious investors, there are opportunities worthy of consideration. It is understandable to be cautious given the many international situations that impact on the economy.

But, it is worthwhile considering that stock market performance in years of apparent crisis proves that sensible long-term investors should always benefit and let’s face it, the current Ukraine situation is having severe repercussions on the international economy.

Prudent investing depends partly on buying quality equity investments and holding on to them – “time in the market, not timing the market.”

Investors can probably think of dozens of reasons not to be in the stock market, as they may have done during the Falklands War and the 2003 invasion of Iraq, but that patience will reap rewards.

It’s easy to think of a reason not to invest but a buy-and-hold strategy that emphasises diversification offers an opportunity to build wealth over time, despite short-term market fluctuations.

It was true several decades ago, and it’s still true today. That’s why we think the stock market is a good place for long-term investors.

The spread of investments and the quality of the product portfolio offers the best protection to investors and the regular reviewing of this keeps it in the most appropriate arena.

A good adviser will keep clients abreast of all the market changes and will frequently revisit the portfolio making suggestions at each review.

For more information contact Becky Hammonds on: 01782 331158 or 07969 269677 or email becky@willowfs.co.uk